Invoicing Guidelines

Invoicing Guidelines

General Requirements

All invoices submitted to Rivian must meet the following requirements

1 All invoices are required to be associated with a valid PO number to be accepted for review

2 All Rivian's indirect POs will be issued through Coupa. Vendors can view and invoice the purchase orders through their CSP account unless otherwise instructed

3Tax, Shipping, Handling, and Miscellaneous should be added to the invoice in a separate section and will not be reflected as a PO line item

4 Invoices will be paid per the terms on the PO. Please make sure all information on the PO is correct before submitting an invoice

- Unless otherwise explicitly set forth in writing and agreed to by Rivian, all POs are under the standard terms of Net 60

- Payment schedule will be based off the invoice date that is listed in Coupa. Please make sure the invoice date submitted matches the invoice copy

Invoicing Guidelines

Create and Edit Invoices

Unless otherwise instructed, all invoices need to be submitted through CSP

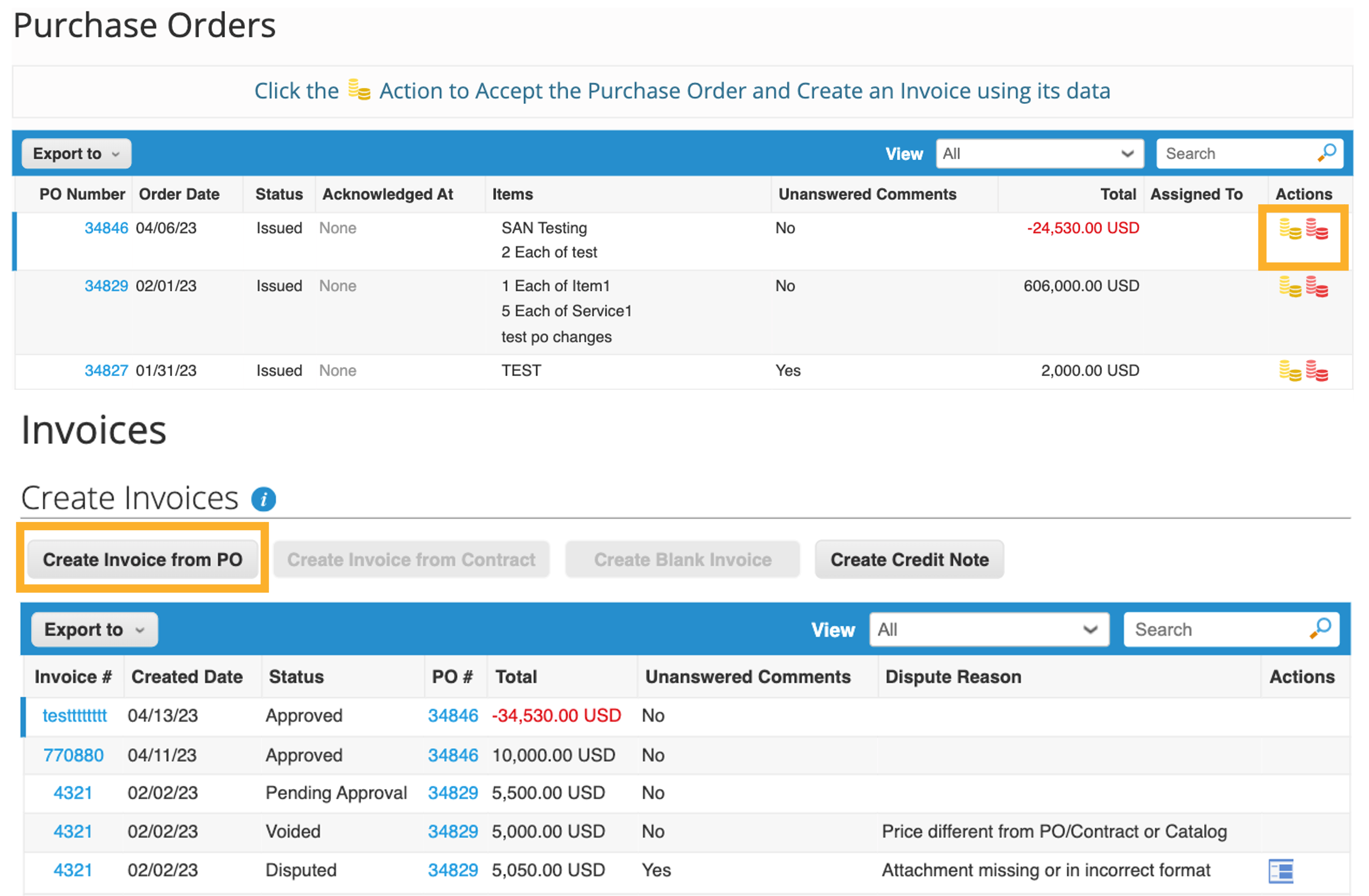

There are two ways to access the “Create Invoice” Page to generate an invoice against a PO

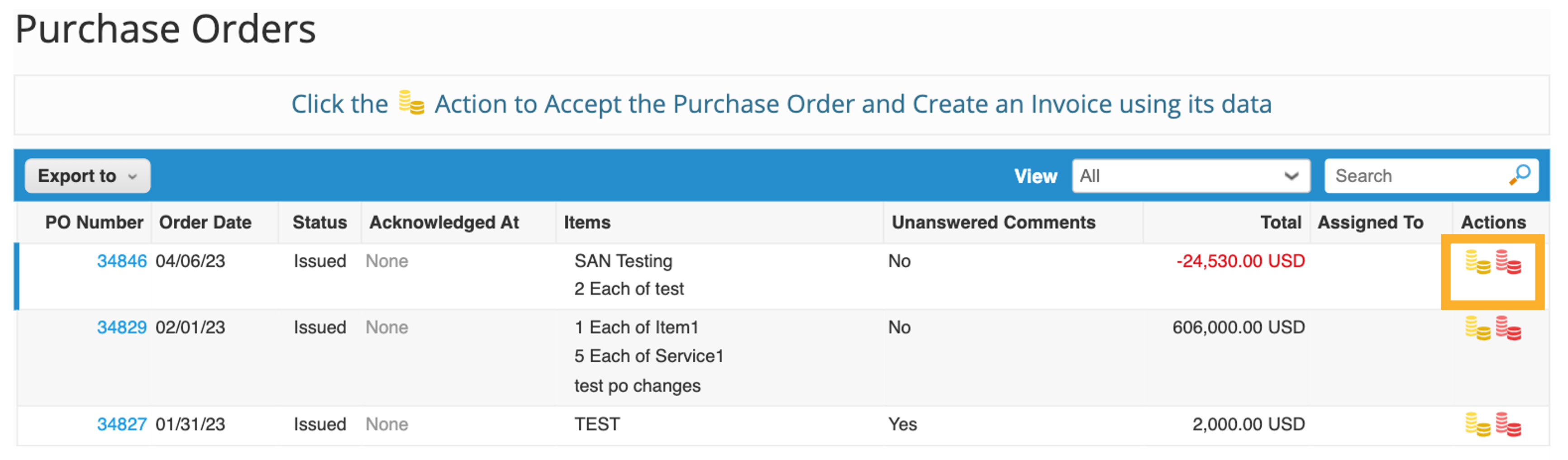

- Option 1: Navigate to the Orders tab, click on the yellow "Create Invoice " icon in the action column of the PO you'd like to invoice.

- Option 2: From the Invoice tab, click "Create Invoice from PO" and click on the "Create Invoice" icon.

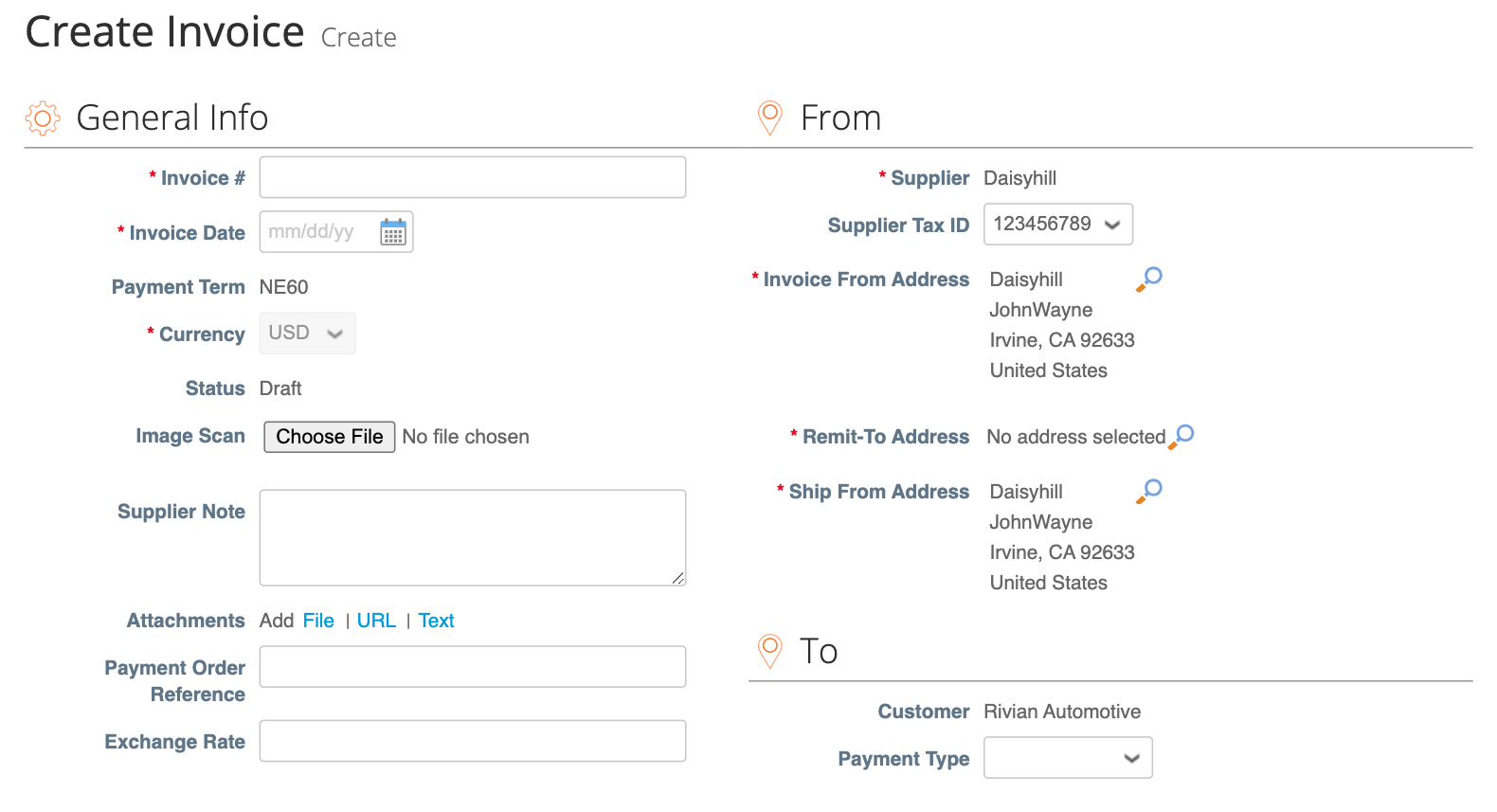

Once on the “Create Invoice” Page, you will be prompt to fill in the mandatory fields:

-

General Info

- Invoice#: Please provide your unique invoice number for submission.

- Invoice Date: Defaulted as today's date. Update as needed to match the date services or goods were delivered.

- Currency: Will match the currency on the PO

- Attachments: Please attach any invoice copy/support documents here. An invoice submitted without attachments will be rejected.

-

From

- The invoice from, remit-to, and ship from address will be auto-populated to your default. Click on the corresponding magnifying glass icon to update or add new address as needed.

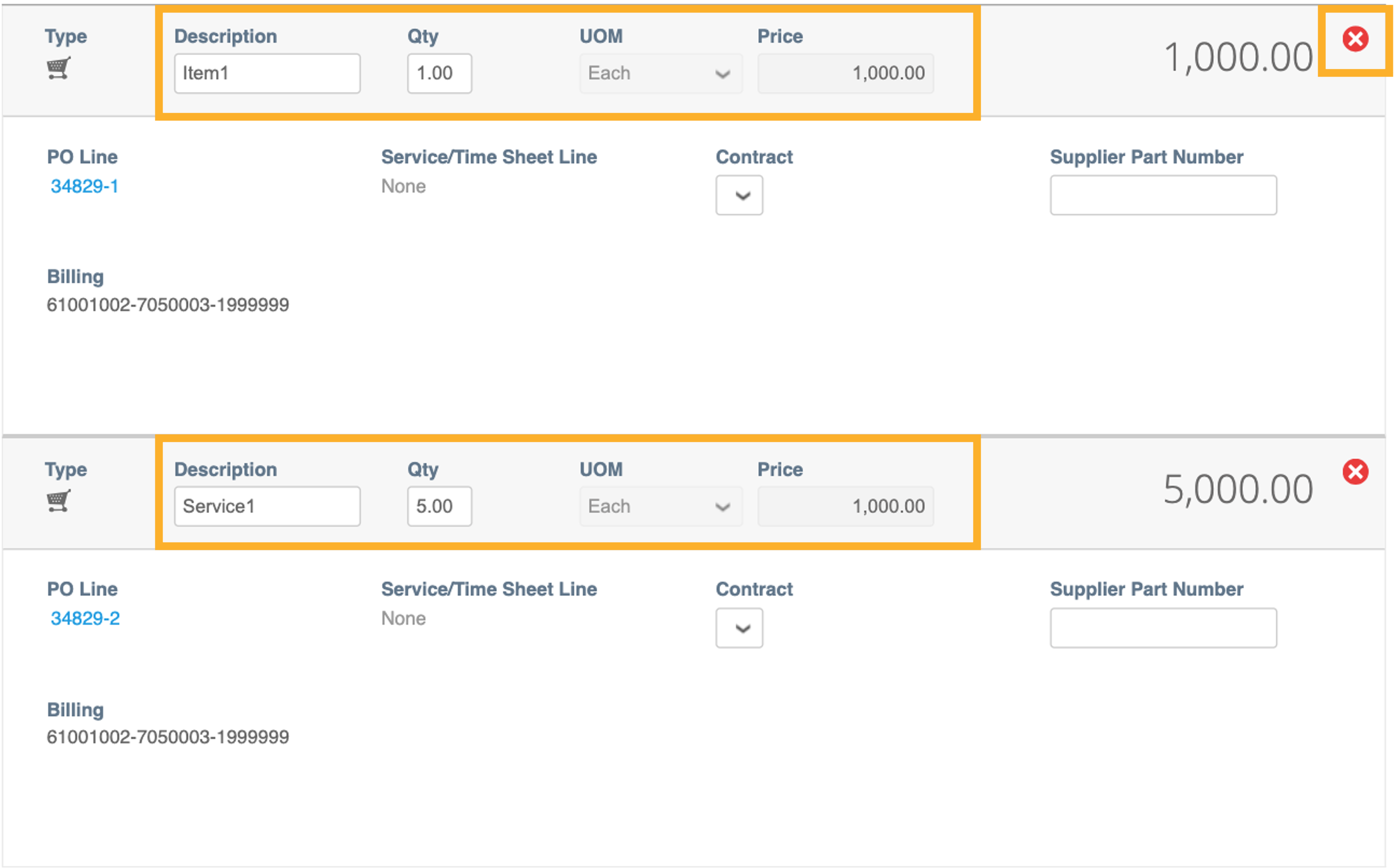

Invoice Line Creation: QTY Based Lines

- Lines with Description, QTY, UOM, Price.

- QTY can be modified to create a partial invoice, decimals are allowed.

- If more than one invoice will be submitted for one line, please make sure QTY is modified for each invoice.

- If the partial invoice does not include a particular line, please click on the red delete icon to remove it from the invoice, only leaving the PO line intended for the current payment due.

Invoice Line Creation: AMT Based Lines

- Lines with Description, Price.

- Price can be modified to create a partial invoice.

- It is recommended that the lines are in the AMT format for partial invoices. If you need the format to be corrected, please reach out to purchasingsupport@rivian.com.

DO NOT input 0 on any lines

A PO was created for the entire year with 12 lines/months in total - to bill only January, you will have to delete the other 11 lines leaving only the line for January on the invoice. Invoice will be rejected if not done correctly. Please reach out to accountspayable@rivian.com if any questions.

Total & Taxes

- Enter values for shipping, handling, miscellaneous costs.

-

Enter the tax amount and click on the + icon if multiple types of taxes are being collected

- For VAT, GST, PST, QST, etc., please select the applicable tax code from the drop-down for the amount to populate.

- For import brokers that are inputting VAT for import goods, no tax code is required, input total VAT amount only.

- Click Calculate to confirm the total amount of the invoice.

- Click Submit.

Invoicing Guidelines

Disputed Invoices

Invoices with disputed status are invoices with information that Rivian does not agree to, needs clarification on, or finds incorrect

When the status of an invoice changes to "Disputed", you receive an email notification with the invoice number, the date of the dispute, the reason for the dispute, and optionally comments on what needs to be modified.

On the Invoice page, click on the Invoice number or use the Resolve button to action against the disputed invoice that you want to resolve.

- Void: If an invoice was issued in duplicate or has already been paid for through an earlier invoice, void it.

- Correct Invoice: If an invoice has incorrect information, you can edit the details. When submitting a corrected invoice, you can use the same invoice#.

In the event where Void and Correct Invoice are not an option, you can cancel or adjust the invoice by creating a credit note. (see steps below)

- Cancel Invoice: If the invoice was issued in duplicate or has incorrect information other than price or quantity, for example, incorrect tax rate or description. Please cancel and issue a new corrected invoice. Please note: The new corrected invoice must have a new invoice#.

- Adjust Invoice: If the incorrect information on the invoice is only the price and/or quantity, an adjustment credit note (partial credit) can be issued to correct it. You can adjust credit line quantity also in case of returned goods or if an invoice has already been paid for.

Invoicing Guidelines

Create Credit Notes

Credit notes can only be created for invoices in Disputed or Approved status

Issue credit notes to resolve a dispute on an invoice, correct an invoice, or cancel a duplicate invoice. Or record miscellaneous credit, for example, return/cancellation of goods, price adjustments, rebates and refunds.

- To create a credit note, go to the Orders page, click on the red Create Credit Note icon in the Actions column of the PO you'd like to invoice.

The process of Create Credit Note is very similar to Create an Invoice

-

General Info

- Credit Note#: Please provide a unique credit note numberfor submission

- Credit Note Date: The date credit note is created and issued

- Currency:Will match the currency on the PO and original invoice

- Original Invoice#: The invoice# creditingagainst

- Original Invoice Date: The original invoice date of the invoice crediting against

- Attachments: Please attach file or image scan supporting documentation

-

From

- Since a credit note is created based on an existing invoice, the From/To section will mirror the original invoice.

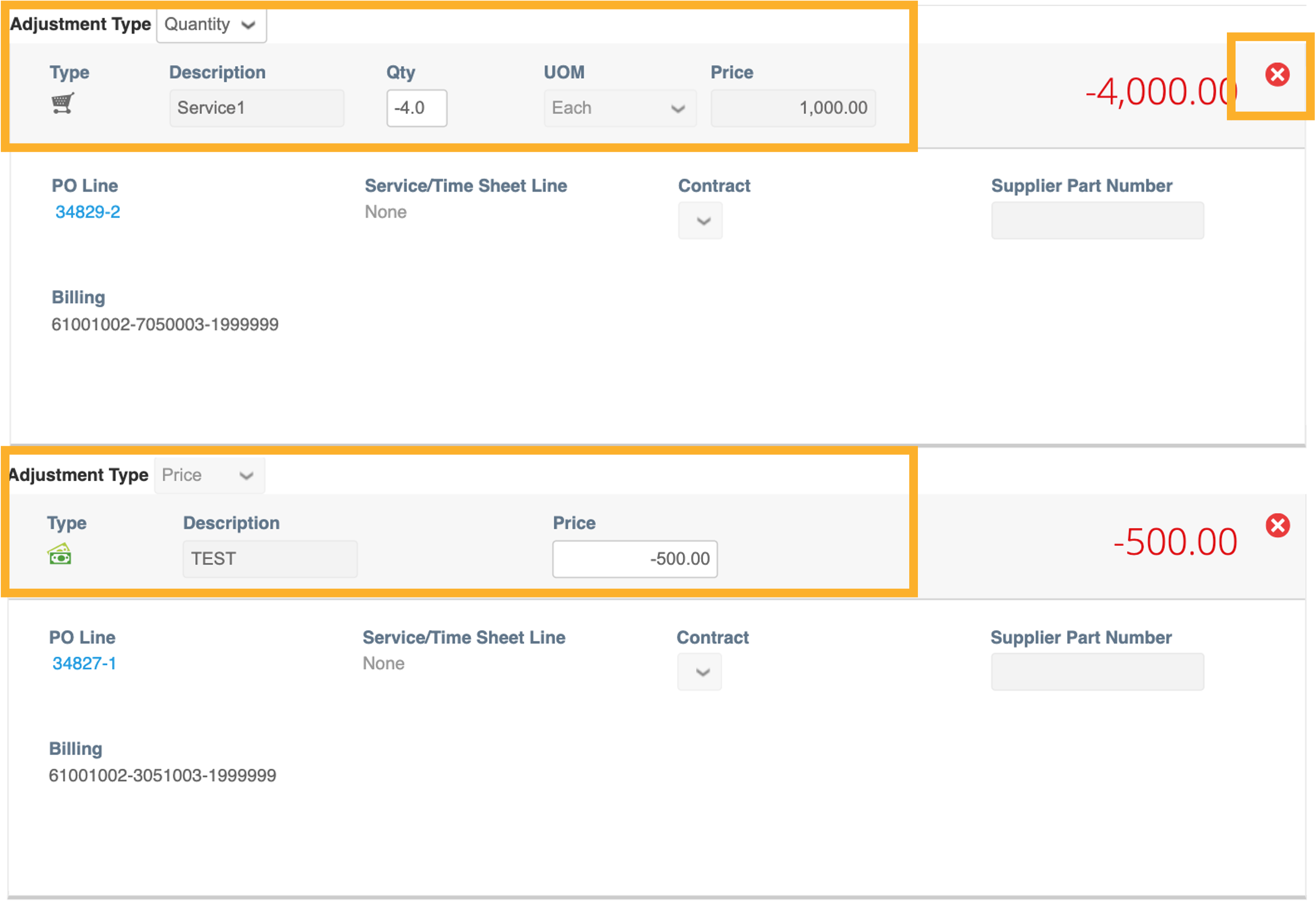

Lines

- QTY based lines:

- Lines with Description, QTY, UOM,Price

-

Choose adjustment types:

- Quantity: QTY editable (negative value)

- Price: Price editable (positive value)

- Other: Both editable

-

AMT based lines:

- Lines with Description, Price

- Price can be modified

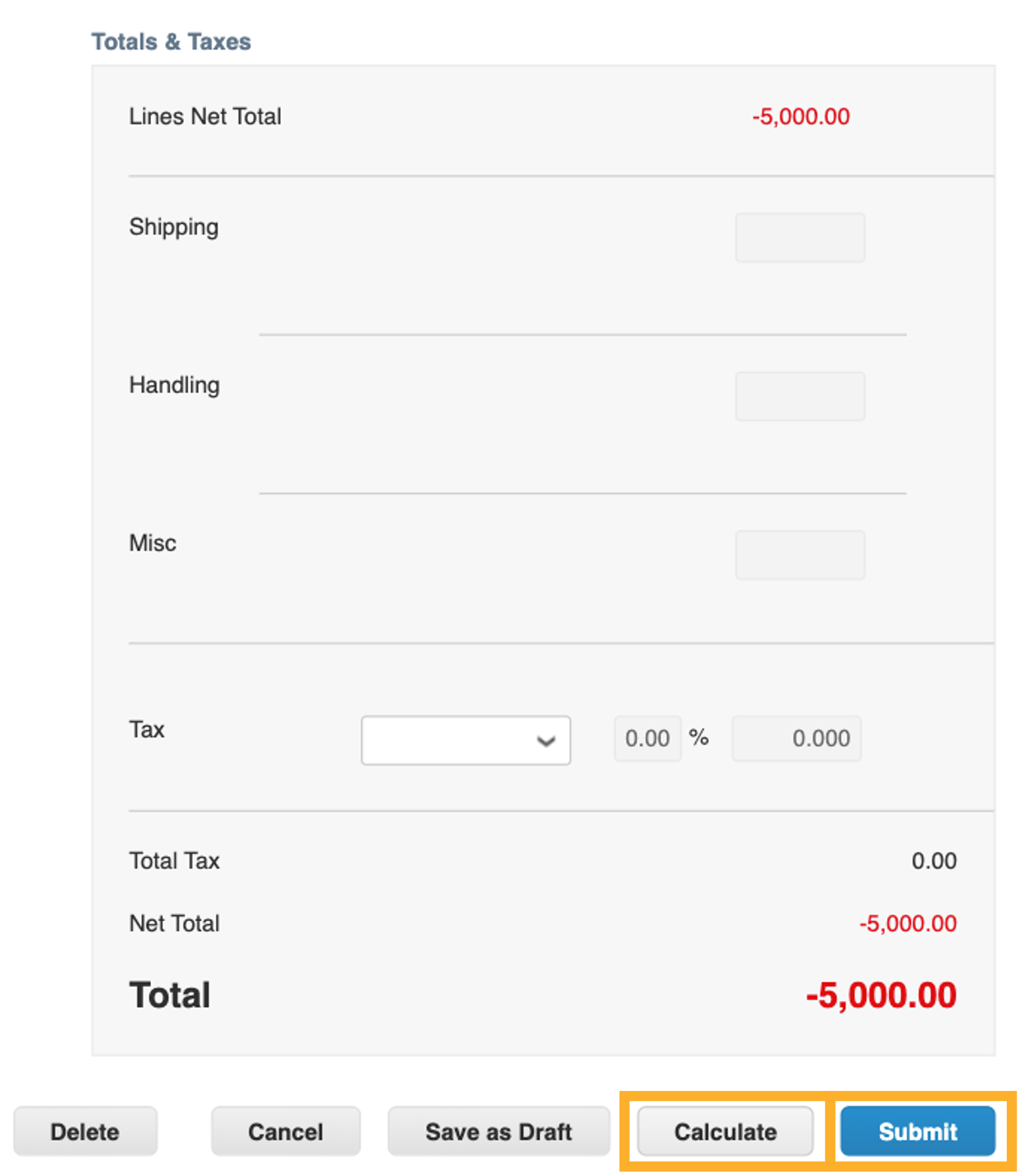

Total & Taxes

- Enter values for shipping, handling, miscellaneous costs

-

Enter the tax amount and click on the + icon if multiple types of taxes are being collected

- For VAT, GST, PST, QST, etc., please select the applicable tax code from the drop-down for the amount to populate

- For import brokers that are inputting VAT for import goods, no tax code is required, input total VAT amount only

- Click Calculate to confirm the total amount of the invoice

- Click Submit

Invoicing Guidelines

General Requirements for AP Mailbox Invoicing

Please take note of the requirements in the event where you need to submit an invoice through AP mailbox

If not submitting through CSP, please make sure your invoice meets the following requirements before submitting to AP Mailbox (accountspayable@rivian.com):

- PO # needs to be listed/visible

- Unique invoice#

- Attach a copy of invoice in the email

- Currency needs to be listed, especially if not USD

- Invoice date

- Items on the invoice need to match the PO line descriptions

- If tax and/or shipping is applicable it needs to be separated

- Anything special (due on receipt, prepaid,credit card payment etc.) should be called out in the emails

Invoicing Guidelines

General Requirements for AP Mailbox Crediting

Please take note of the requirements in the event where you need to submit an credit note through AP mailbox

If not submitting through CSP, please make sure your credit notes have the following information when submitting to AP Mailbox (accountspayable@rivian.com):

- Original invoice # should be listed

- Original PO # should be listed

- Attach a copy of the credit memo

-

Currency needs to be listed, especially if not USD

- If you plan on continuing to do business with Rivian, please process a credit memo and not a refund request

Invoicing Guidelines

Payment Schedule & Support

Please take note of the requirements in the event where you need to submit an credit note through AP mailbox

Payment Processing Schedule

-

Payment Due Date:

Calculated based off the Invoice Date that is listed on the Coupa invoice. Please make sure the invoice date submitted matches the invoice copy.

- For example: Invoice date 4/11/23, NE60 -> Payment date 6/11/23

- Payment Cycle: Rivian payment cycles are on Tuesdays and Thursdays

Additional Support

-

Reasons to reach out to accountspayable@rivian.com:

- Support invoicing through CSP

- Need clarification on a dispute/rejected invoice

- Need to have AP enter invoice

- If not linked to CSP - status of invoice/payment if late

- Statements

-

Reasons to reach out to appayments@rivian.com:

- Remittance information

- Need payment verification/check cleared